Florida policymakers increased the gasoline penny tax to 7 cents per gallon in 1931. It was not until 40 years later, in 1971, that legislators raised it to 8 cents per gallon, with proceeds shared equally between the state and local governments. The rate remained constant until 1983, at which point the state dropped its share of the gasoline tax and replaced it with a sales tax. As of 2022, the state’s fuel sales tax stands at 15 cents per gallon, a major regressive tax nearly 100 years old.

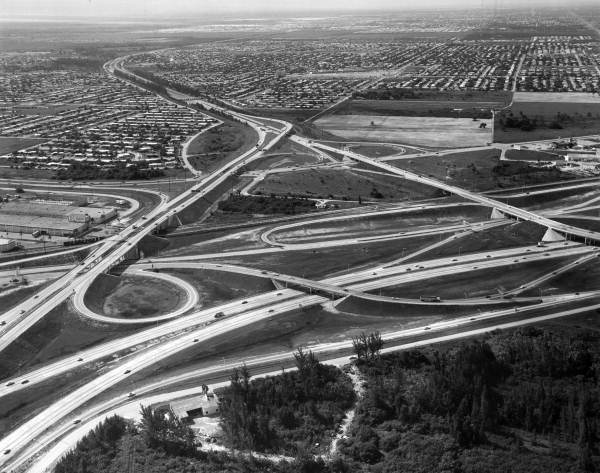

Fuel taxes function on the “benefits principle,” meaning that taxes are imposed on those who receive the benefit (e.g., infrastructure) associated with the tax. However, as automobiles become more energy efficient, those who can afford to buy these vehicles will continue to benefit from Florida’s infrastructure while those who cannot afford the same models will end up paying for it via fuel taxes. Additionally, the impact of racist highway planning, which began to take shape after the Federal Aid Highway Act of 1956, routed some highways directly, and sometimes intentionally, through Black and brown communities. Florida’s infrastructure was built at the expense of Black and brown communities’ health, success, and economic opportunity. For example, 10 Black churches were razed to build I-275 in St. Petersburg; construction of a 40-block I-95 interchange displaced over 10,000 Black people from Overtown in Miami, destroyed its bustling business district and uprooted Florida’s “Harlem of the South”; and I-4 in Orlando was purposefully placed to segregate the Black and white sides of town. The costs and benefits associated with fuel taxes have never been shared equally.