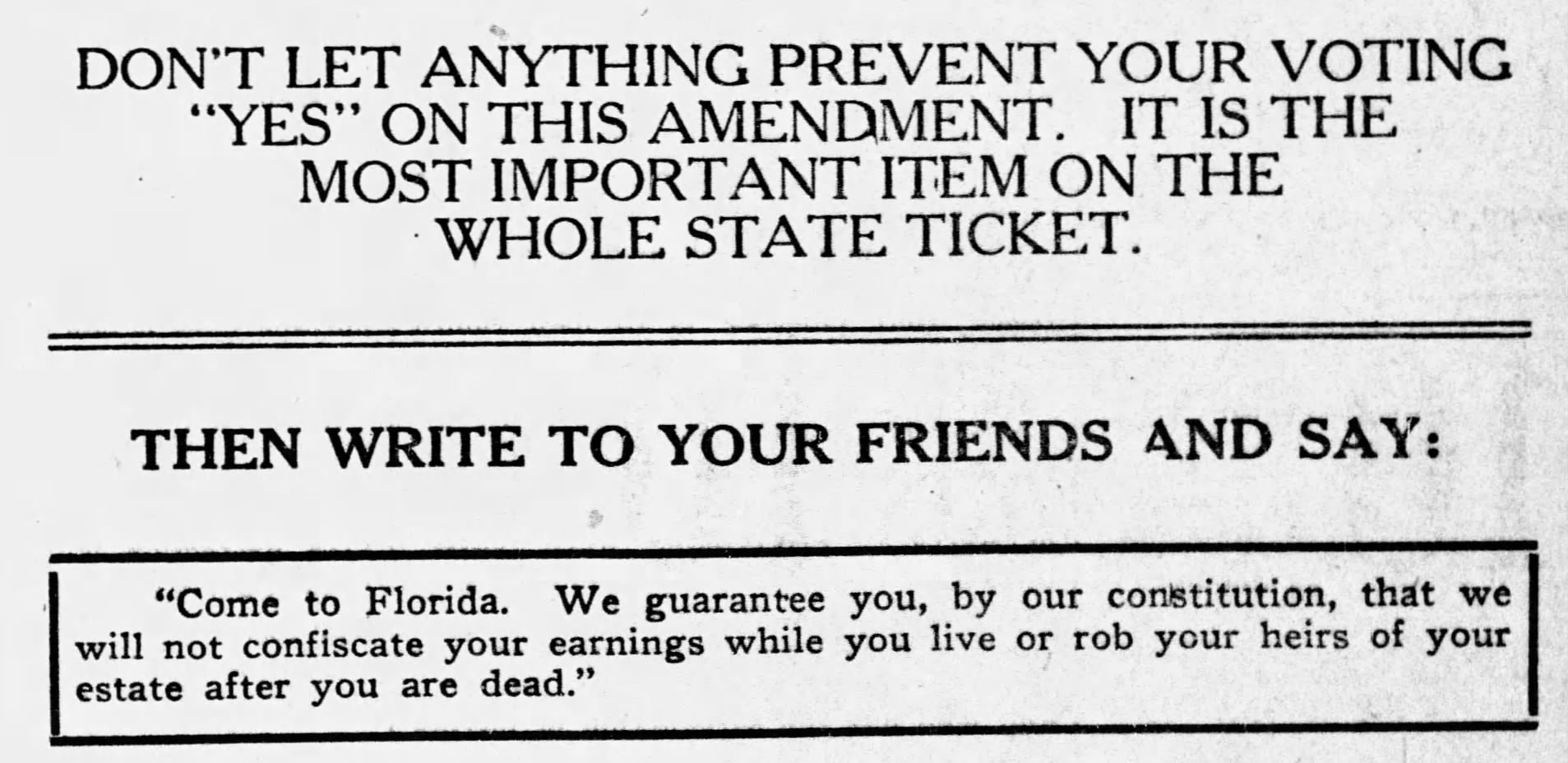

The state Legislature passed, and voters approved, a constitutional amendment to prohibit personal income and inheritance (or estate) taxes in Florida. The thinking was that without these taxes, Florida would be able to attract wealthy residents, who would in turn bring with them capital and economic growth. Due to generations of racism and unequal access to build and transfer wealth, these changes to the tax code disproportionately benefited wealthy white residents at the expense of funding for public services. Additionally, these changes guaranteed that Florida’s state revenue would have to come from other, regressive, sources.

The promise of wealth and growth did not materialize. In 1924, few people could have guessed that Florida’s real estate and tourism boom would come to a screeching halt by 1926. Just as few could have guessed that the U.S. stock market would crash in 1929, leading to the Great Depression. The choice to outlaw personal income and inheritance taxes left the state without a powerful source of revenue, one that could have been used to address the legacy of unequal public services that limits opportunities for all Floridians and disproportionately harms communities of color. Finally, the 1924 electoral decision to outlaw personal income taxes was not representative of all Floridians. At the time, there were harsh barriers like “whites-only” primaries, poll taxes, literacy tests, and long residency requirements to disenfranchise Black voters, as well as Floridians with low to moderate income.

Since Florida does not currently have a personal income tax, the state has the third-most regressive (or upside-down) tax code in the country. Although Florida families of all races and ethnicities earning under $86,000 (about 80 percent of taxpayers) receive just 34 percent of all income, they pay 53 percent of all taxes. So, while taxes are low for the wealthiest households, Florida’s tax code ensures that residents of modest means contribute the most to finance public services, like libraries and roads, which benefit all Floridians. The state could adopt a personal income tax to offset the state’s upside-down tax code and generate more revenue to spend on good schools, safe and affordable housing, reliable transportation infrastructure, clean water and energy, and a robust safety net. A personal income tax set at just 1 percent of taxable federal income, with an exemption for those with income less than $60,000, would generate more than $2.5 billion annually. This would increase the quality of public services, which in turn would help address decades of unequal opportunities.